3 reasons why you might need to review your mortgage

Over the past 12 months, there have been many changes in the market that will impact buy-to-let landlords with mortgages. Whether you have one or 10 investment properties and regardless of how hands on you are, here are just three reasons why it could be time to review your mortgage and restructure your portfolio.

Reason #1 – Interest rate rise

Earlier this month, the Bank of England increased the base rate from 0.25% to 0.5% for the first time in a decade. This is expected to increase mortgage payments for both home owners and buy-to-let investors almost immediately. For those on variable rate and tracker products and anyone with fixed-rate products could be in for a more expensive deal when their current one comes to an end.

While the financial impact is likely to be minimal for many property owners – approximately £200 per year on average for every £100,000 borrowed – forecasts suggest that there could be two more interest rate rises in the next three years*.

The good news is that many lenders will be working on launching new competitive products to entice borrowers who feel like now is the time to review their current mortgage. As it stands, many lenders are still offering two-year fixed rates

under 2%.

Reason #2 – Removal of mortgage interest tax relief

In the 2015 Summer Budget, it was announced that private landlords (who own properties in their individual names) will no longer be able to deduct 100% of their finance costs, including mortgage interest, as an expense before calculating their taxable income.

Known as the Tenant Tax, or formally Section 24 of the Finance Act (No. 2) 2015, it means that from the tax year beginning April 2017, landlords will gradually see their tax bill rise as the changes are phased in. By 2020, tax relief on finance costs will be restricted to the basic

rate of tax.

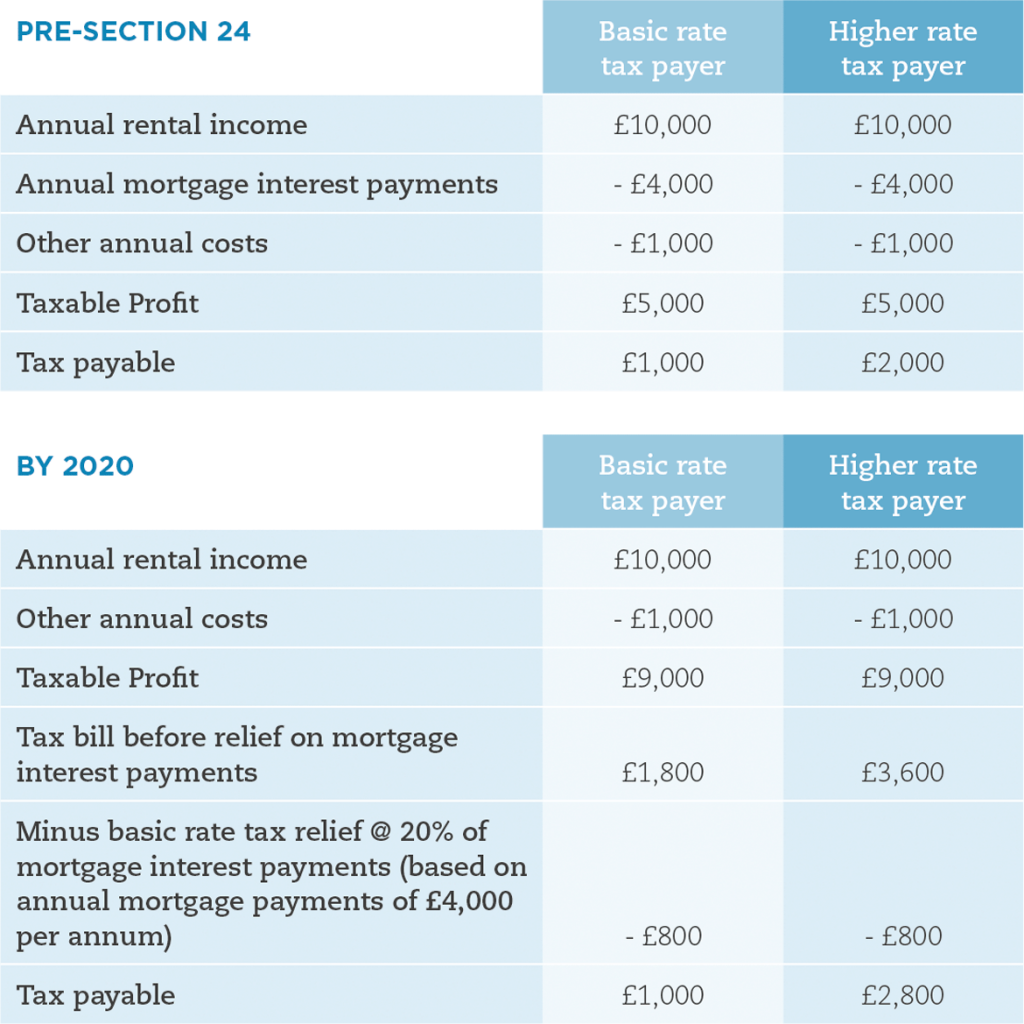

The following tables show in simple terms how this could affect landlords who are basic rate tax payers and higher rate tax payers before Section 24 and once it is fully implemented by 2020.

As the tables show, profit will now be calculated before any mortgage interest costs are deducted, artificially inflating it to £9,000. Only then can the 20% relief be applied.

Higher rate tax payers will therefore see an immediate increase in their tax bill by the time Section 24 is fully implemented in 2020. And while it seems that lower rate tax payers will see no change to their tax bill, it could push millions of people into the higher rate bracket.

For example, by 2020, the higher rate threshold will be £50,000. If someone earns £43,000, then under the old system, their £5,000 profit from buy-to-let would keep them in the lower rate bracket. In future, the higher figure of £9,000 will be used to calculate their total income, which will increase to £52,000.

Reason #3 – New PRA Regulations

In response to Section 24, the Prudential Regulatory Authority (PRA) last year recommended increased stress testing on buy-to-let mortgages. Generally, lenders based these on 125% rental cover and a 5% interest rate but these have now been formalised and increased to 145% and 5.5% respectively.

In laymen terms, if you wanted to borrow £100,000 for a buy-to-let mortgage, you would have needed to achieve a monthly rental income of £521. Now, it is more likely that lenders will require a monthly rental income of £665.

Then in October this year, the PRA introduced new underwriting standards that require lenders to assess the performance of an entire buy-to-let portfolio where a landlord has four or more

rental properties.

This means that even if the lender is only lending on one property, they will need to ensure that the portfolio is performing well on average and is likely to take into account total buy-to-let mortgage borrowing, total rental income and ask for a written

business plan.

Here to help

Fortunately, by effective financial planning and implementing the right business structure, the impact on you and your portfolio can be minimised.

At Bluechip Financial, we have been advising landlords for over 10 years and there isn’t anything about buy-to-let borrowing that we haven’t found a solution for. If you’d like support and guidance on how these changes will affect you and how they can be mitigated, we’d be happy to review your current circumstances and can advise on the options for cost effectively restructuring your borrowing in line with your personal and portfolio goals.

Please contact one of our professional advisers now for a free consultation. Call us today on 01202 692222.

*http://www.mirror.co.uk/money/confirmed-more-interest-rate-rises-11491051

A mortgage is a loan secured against your home or property. Your home or property may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

Information is based on our current understanding of taxation legislation and regulations. Any levels and bases of, and reliefs from taxation are subject to change.

Leave a Reply